Ever since the Affordable Care Act passed, my health insurance premium has been climbing faster than a Titan rocket, which should have prepared me for this year’s rate jump. It still managed to catch me off guard.

To give a little background, before the Affordable Care Act I paid $423/month to insure a family of six. The passage of the Act brought an immediate $250/month increase, with increases every year since. Last year I got sucker-punched with a $270/month blow. I thought I’d gotten numb to these rate hikes. Think again.

This year dished out a whopping $340/month jump. That hurt, but worse than the jump itself was the new milestone my premium reached. As of this year, I pay over $2,000 a month to insure my family. Let that number soak in a minute; I know I had to.

With a nice number like $2,000 the math becomes too easy to hide from. $2,000 a month adds up to $24,000 a year. Twenty-four thousand dollars. TWENTY-FOUR THOUSAND. I struggle to even say the number, much less breathe while I do it.

As I continue struggling to wrap my mind around that number, I can’t help but imagine what that kind of money could buy if I didn’t have to spend it on health insurance.

So as my way to help ease the pain, here are five things that, for my family at least, are as affordable as health care …

Diamonds, Diamonds, Diamonds

With what I pay for health insurance, I can shower my wife in diamonds. Like maybe a $19,000 2.5 carat rose gold solitaire ring or a $22,000 stunning diamond necklace with a full 10 carats worth of bling. Ok, let’s get serious. I’d buy both. And more. Because for less than the $24,000 a year I shell out for health insurance, I can make an annual trip through Tiffany’s and make my wife sparkle more than Lil Wayne’s mouth.

Carribbean Cruise for Two. In a Suite. Monthly.

For about $1,000/person, I can take a three-day Caribbean Cruise for two, complete with airfare to Florida. And not in the custodial-closet cabins, mind you, but a full suite with a balcony. And I can do it every single month for the rest of my life.

Two Pet Tigers

Tigers only cost $10,000 each (source). So I’ll buy two. Granted, there’s also the cost of feeding them, but that only rises to about $5,000 a year for the pair. Early into the second year, I’ll have my tigers paid for in full and eating like kings (of the jungle) with almost 20 grand to spare. Zebras next? (Separate enclosure, of course; $7,000 each).

Two Porsches

I can lease a Porsche 911 Carrera for about $1,000 a month. So let’s make that two, please. Oh wait, I have to worry about car insurance. So never mind. Let’s switch to a Ferrari California for $1,500 a month, leaving me with an extra $500/month for the insurance and all the gas I want. And just for fun, I’ll toss out a few bucks to get a shiny, custom license plate frame that says “THIS is MY affordable care!”

A Second Home

I now pay more for my health insurance than for my MORTGAGE and CAR PAYMENTS COMBINED.

In other words, for the cost of health insurance, I can easily buy a second house. And not a cheap house either. A house that will put my current, 20 year-old starter home to shame: a half-million-dollar second home. (source)

(Which, let’s be honest, is just sad.)

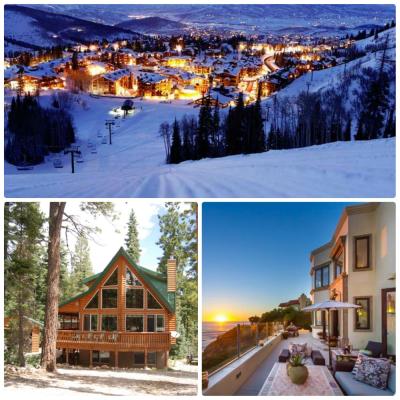

But who needs a second residence? With that kind of money, let’s go big. I’m thinking vacation home, like a ski condo in Park City or Aspen. Or a log cabin in Montana. Or a trendy, beachfront pad in San Diego. A half million dollars will take my dreams a lot of places.

Or … Health Insurance

Back to reality, what do I actually spend $24,000 a year on? Health insurance. Basic health coverage for my family. Nothing special, no Cadillac plans, just run-of-the-mill health insurance. Oh wait, don’t forget that deductible! We’d better ratchet up the effective price if we expect to actually use the health insurance. Plus the 20% copay, of course.

And that, folks, is what we call affordable care.